Accounting Best Practices for Property Managers

Jesse Ehret

Founder & CEO

Becoming a professional short-term rental property manager should come with a warning label: Accounting Expertise Required. In an episode of Short Term Rental Solutions, Jesse Ehret, CPA and CEO of Ximplifi Accounting Simplified, walks through some of the key financial topics property managers should understand to navigate complexity and scale their business.

Accounting for property managers: What are the best practices to follow and how can Ximplifi help?

Read the episode transcription below to learn what Jesse Ehret, CPA and CEO of Ximplifi, recommends to help property managers overcome accounting challenges and gain a better understanding of their company financials.

Content has been lightly edited for brevity and clarity

Would you take a moment to introduce yourself to the listeners of the show today?

“My name is Jesse I’ve been a CPA for gosh too many years now but I spent about 10 years in public accounting. I started off with Price Waterhouse Cooper, which is where I spent the better part of about a decade. I then became the CFO of a small but ultra luxury real estate investment company that also rented luxury properties on a short-term rental basis as well as managing a nice portfolio of ultra luxury homes actually all over the world.

So I was privileged to get that position and was largely tasked with transforming their finance function, which I did by leveraging technology and built up a great accounting team there. I did that for a couple years, and I guess I always had a dream or a bit of an urge in the back of my mind that wanted to start my own company, so that’s how we founded Ximplifi.

We really hung our hat on being almost exclusively focused in the vacation rental business because I felt it’s an industry that needed some leadership, both from a technology and an accounting perspective. So you know that’s what we did, started just over 5 years ago now, and it’s been a great ride. It’s really turned out to be a great decision to focus in this industry.”

So, let’s get right into it. There’s cash basis and accrual basis accounting – is one preferred over the other? Does it matter what we choose to do whether we’re just an individual property owner versus a property manager?

“Well, it’s a complicated subject and then you throw in trust accounting and all that – it gets even more complicated. Certainly, first I think it’s important to just define what’s cash accounting versus what’s accrual accounting because some people might not even quite understand that.

Cash accounting

So if I think about cash accounting, when I receive cash, I recognize income. So that means if I receive money today for a reservation that’s going to, you know, not arrive for two or three months, that means I’m going to record the revenue today when I receive the cash, and then later on down the road, maybe when I pay out the owner, I might record that as a cost of goods.

Accrual accounting

Now that is by far not my preferred approach to short-term rental accounting, but certainly that’s an approach that some people take. So if we go to the flip side and look at accrual accounting for property managers, it says that if I receive a booking today, I may receive cash today, but actually that’s going to sit as an advanced deposit until that guest arrives.

Then when that check-in occurs, I’m either going to recognize that revenue over the life of the stay, or maybe I just recognize all of it on check-in or departure. So that would be the difference between accrual versus cash. Certainly as an accountant we prefer the accrual method of accounting for property managers because it’s the best way to achieve what we call revenue and expense matching. That means if I want to understand how I’m performing in this particular month, I really need to match up my expenses with the time period when I’m actually earning that revenue.

So the idea is that I’m earning revenue when that guest arrives. The other piece of the puzzle is: do I show revenue (for example the accommodation fare that I’m going to pay out to an owner) as my revenue, or do I put that on a balance sheet (basically as a liability) and then only recognize my management commissions?

How to report revenues as a vacation rental manager

So this is again a tricky subject, but certainly the best practice in the industry is to actually record the owner’s revenue as a liability or basically a payable to them, and make the revenue that’s shown on your income statement the management commissions, maybe cleaning fees, other ancillary fees that you’re going to be earning as the management company. In any case you are not actually showing the accommodation fare on your P&L as a management company.

Those are subjects that we help clients think through and use best practices, so that they can benchmark themselves against other companies. We also know a lot of people might want to sell their business someday, so having really good books where people can go back two or three years or more and have financials in line with industry standards is important to getting that that top line that you want to see for your business “

One aspect of property management accounting that’s often confused is the distinction between rents and revenues. How would you explain that to someone who may or may not realize that there actually is a distinction?

“Sure, this actually goes beyond just short-term rental accounting. Consider how any property management company recognizes their revenue. Say you’re a property manager and you’re receiving a monthly lease on behalf of a landlord that owns a piece of property, but you’re maintaining it and collecting the money for them from the lessee, how would you treat those rents that you’re collecting? Well you know as soon as that money hits your bank account, it’s a payable to another owner, so it’s not your revenue.

The revenue that you’re earning is your management commission, perhaps cleaning fees, and the other ancillary fees that I talked about earlier – damage waiver, maybe you charge a booking fee, maybe there’s different fees that you charge the owner – and so that’s really your revenue that you’ve earned as the management company. A lot of people will use the term “rents in trust”, so when I receive rents, that’s “rents in trust” – and that basically means you have rents that are in trust of other people.

So that’s how we typically help clients think about it, which will throw people off because maybe they haven’t been following that methodology since they started their business.”

What happens if you get a deposit that’s 50% of the total cost of the reservation and the guest ends up canceling before their stay, how does that wash out in the property manager’s accounting?

“Well it all depends, first it begs the question of whether or not the guest falls within their window of cancellation or not, so are you going to keep some of that money or not? In property management accounting and especially when we talk about trust accounting specifically for short-term rentals, we talk a lot about events and triggers.

So when I receive a payment, that triggers a deposit; when I have somebody check in, typically the way most people look at it, that triggers revenue; and so then I’m going to take that cash I received and then apply it against that invoice. So essentially I’m holding onto a bunch of money, I raise an invoice for this person who owes me money, I take their advance deposit and I apply it against their balance – that is essentially how we think about it. So we had two triggers: we had a payment, we had a check- in, but then you have the cancellation which is another trigger. A cancellation is similar to a check-in: something has to happen with that money.

One option is that it remains as an advanced deposit payable out to the guest, or another is that the advanced deposit is now forfeited (either all or part of it). If that’s the case then I’m going to recognize revenue in some way or another. Then you need to know what does the management contract say – does the property manager keep all of that cancellation income, or is it shared with the owner? If it’s paid out to the owner can you charge commissions on it?

So there’s always a lot of these rules in tracking the money around refunds and cancellations. There’s always a fun edge case that you have to deal with. Most systems can automate it for the most part, but there’s always still a bit of manual eyeing that you have to do to make sure you get it right.”

If I’m a property manager reporting lodging tax and I received money for a reservation, do I report that in the same month it was received, or do I wait until the guest checks in? Is there a right or a wrong way for that?

“This is another kind of gray area. I have heard some states make the argument that when you receive the cash, the sales tax is due. I’ve pushed back pretty considerably on that, and I would say that’s the rare case of how people recognize and report revenue, largely because you’re taking an advanced deposit and also that advanced deposit isn’t even yours, so you’re holding it on behalf of somebody else.

Therefore typically what we see in practice is if we take that money in as an advanced deposit, some of that is taxes. At the moment of check in, that advanced deposit is then split into a bunch of different line items – some is accommodation fare some is cleaning fee, some is sales tax payable – and so that advanced deposit then basically splits into those three buckets. Some of that’s going to go to the owner, some of that goes to you, and then obviously the sales tax payable, again is what we call a liability due to your tax authority that you’re then going to pay out.

It’s important to note that your filing timeline is very much going to be dependent upon where you’re filing. You can have times where you file monthly with a city but you file quarterly with the state, right so that really varies from jurisdiction to jurisdiction. Either way, then you also have to beg the question of what’s your revenue by property by channel because Airbnb might pay some of your taxes if you’re what’s called The Merchant of record – if you’re taking payments through stripe or another Merchant processor, You’re The Merchant of record. So it really does get complex from a sales tax perspective.

I can tell you safely that even on our team the most complex and challenging problem for our staff to solve is sales tax. It’s a tough one, very easy to mess up, a lot of complexities. We’re actually working on having an integration with Avalara MyLodgeTax soon but generally speaking we work with them to file and stay in compliance for all of our clients.

I will say if you’re operating multiple jurisdictions, you know Colorado is really tough one, each city and county is different. So if you’re operating in Colorado and you’ve got some in Silverthorn, and you have some up in Breckenridge, and you have some over in Beaver Creek and Vail, the reporting in each one of those areas is so different, and staying in compliance from a registration and Licensing standpoint is really really tough. So that’s where we find services like MyLodgeTax really come in and save the day for us. “

Cost of goods sold versus fixed costs: what is it tracking and how and why should we be tracking these business expenses?

“Well for one, if we talk about cost of goods sold, a lot of people also refer to that as direct cost. So direct cost is probably your cleaning labor or your house labor. A lot of my clients will even put a lot of their vacation rental software such as their pricing software or even their PMS software as a direct cost. A lot of those are variable and those are direct costs associated with earning your top line revenue. But the easiest ones and what I see frequently lands in that direct cost bucket is your maintenance labor because you’re going to have maintenance revenue ideally, cleaning lab labor, cleaning supplies, and other direct guest-related expenses such as channel commissions and merchant fees.

A lot of times I’ll see merchant fees down below but I really encourage people put those merchant fees up above the line or in those direct costs, and here’s the reason why.

The idea behind this is from a property manager’s accounting perspective we use the term profit margin and in this industry sometimes we’ll use the term take rate or net management revenue. All those terms are are used interchangeably and can mean slightly different things, but at the end of the day what we’re trying to understand is this: for every rent dollar that you sell, how much profit margin are you making that is going to support your overhead cost?

The idea is that for every rent dollar that I make I want to have a gross margin – or we could say take rate – which means that for every dollar I’m making between 40 and 50 cents in management revenue, and then I really want to be in the 30% range for gross profit margin and that is going to support all of my overhead and my fixed cost to run my business.”

Is that an industry target that people should be shooting for?

“Absolutely – I would say aim for .40 to .50 or above on take rate – which is your management commissions and ancillary fees as a percentage of all guest fees – and then understand your net management revenue after you’ve deducted your direct costs. Again, we see that the 30 to 40% range is where you’re really performing healthy from that perspective.”

There’s a lot of work involved with year-end accounting processes as a property manager, whether it’s the 1099s and all these different things, so what advice do you have to make this easier?

“I think year-end actually starts at the beginning of the year, if I can state it that way. And the reason is because ideally you have the right systems in place. If you have the right owner statement software in place that’s tracking and reporting to your owners all year and can then consolidate all of that into a nice year-end statement, that certainly eases that burden a bit.

Still, we need to file and report to the IRS all of these rents and revenue that you’ve been collecting and then paying out to your owners. Probably the least understood elements of property management accounting is that when it does come to reporting that year-end number to your owner, you are technically supposed to – and it’s very clear in the IRS guidelines – that you should be reporting your gross rents before commissions or any other fees are deducted. So that’ll confuse a lot of people.

It confuses the owner because they maybe didn’t get paid out that much money, but you’re required to report the revenue that was collected on their behalf, and so that number that you’re reporting is the revenue. It helps when you can produce a year-end statement to show all the deductions that get to the bottom line of what the owner has actually been paid out.

In turn, all of those deductions should be deductions that the owners’ accountant is going to be taking on their tax return (most likely a Schedule E) to get to their taxable income. So owners need to understand that their taxable income should largely match the revenue less all those expenses. The number reported on the 1099 is actually that top line revenue number before commissions and other fees are deducted. So again, it can be complicated for owners but hopefully if you have your systems in place and you educate them correctly, then it won’t be a surprise to them when they receive their 1099.

Let’s quickly walk through why the IRS is doing that and why you want to do it as the property management company: Airbnb and your Merchant processor are required to report all of the revenue that they paid out to you. All that is reported to the IRS, so the IRS assumes you had $10 million in Revenue this year. Now if you collected $10 million from stripe and Airbnb throughout the year but then you only report $7 million to the IRS, well now the IRS sees that difference of $3 million is yours. That’s where you open yourself up to some risk. Now again I think you know you’d probably be able to get through that audit, but the IRS would say you didn’t follow your 1099 correctly. So there is a real reason why you want to do it right. “

Can you tell us more about VRPlatform and give us an idea of how Ximplifi can help property managers out there who need accounting help?

“Well I think the best place to start is just really differentiating between who is Ximplifi and what is VRPlatform. We (Ximplifi) are simply an outsourced accounting and consulting firm – so people come to us and want us to fix their problems, and we take a combined technology and people approach to do that. We want to make sure that you’ve got the right systems, the right accounting software, and leverage your property management software data to set things up as efficiently as possible.

So for property managers who want us to manage their accounting it’s really efficient and easy for us to do that. Clients who come to us say they’ve had trouble finding people that understand this industry, that can produce owner statements on time, or they’re tired of doing it themselves, and they want us to fix it – and that’s what we do.

We work with people managing anywhere from 10 to 20 units up to several thousand, so in total we produce somewhere around 8,000 owner statements a month at this point for people around the globe.

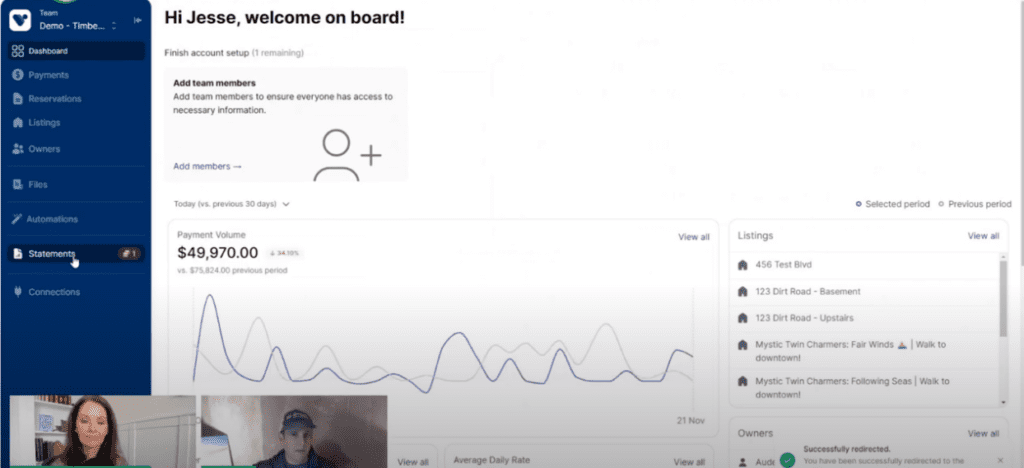

I won’t tell too much of the backstory but in large part we found using accounting features within property management systems to be challenging – that’s where we built a joint venture with some folks out of the UK, resulting in the VRPlatform trust accounting plugin. It plugs into your property management system, into your merchant processor, into Airbnb, and some of your other channels, and brings all that data into one platform, and then automates a lot of the processes around trust accounting for your business as a property management company.

VRPlatform then posts that data within the accounting system of your choice – QuickBooks or Sage Intacct – and from there it’s then going to automate invoices and payments and payouts and reconciliations, etc, finally producing what everybody wants, which is nice, pretty, accurate, timely owner statements for your owner. So that’s what we help our clients do at the end of the day.”

How can people find and connect with you?

The easiest way is to just find us on our website: www.ximplifi.com. You can also find out more at vrplatform.app if you’re interested in signing up to start automating! Otherwise, feel free to email us or follow us on Instagram, LinkedIn, or subscribe to our monthly newsletter.

The fiduciary responsibility of a property manager – even if you’re managing your own properties – is important. Contact Ximplifi to start simplifying today!

Additional Articles

5 Signs You've Outgrown QuickBooks

Frustrated with QuickBooks?

Download the white paper to determine if you need a more sophisticated system to meet your needs.

Contact Us.

Get in touch with us and we will get back to you.

Want to join our monthly newsletter?

View our Privacy Policy

Sage Partner SaaS Agreement