Essential Ximplifying Applications

Jesse Ehret

Founder & CEO

As a company begins to build its accounting systems and processes in the cloud, it may become overwhelmed by the number of apps or not know which cloud-based accounting software to begin with. My review below is certainly not all-encompassing, but it reviews and compares several of the most essential apps necessary to become lean, mean, and Ximplified.

Apps Our Clients Love

Cloud-based Accounting Software

There are a lot options when it comes to could-based accounting software, but the top-rated solutions for small to medium-sized businesses (“SMB’s”) are listed below:

1. QuickBooks Online

In the US, no other software for small businesses has been as successful or become more recognized than QuickBooks. Their QuickBooks Online version is a solid cloud-based accounting software for small businesses, although it does have drawbacks.

Pros: easy to use and to learn, bank feeds, hundreds of apps, easy in-app set-up of merchant account services, multitude of easy standard reports and easy to find knowedgable support.

Cons: no fixed asset ledger, no expense report module, not as intuitive as other software, difficult to use with multi-entities, limited project tracking capabilities, no review and approval processes, lackluster customer support, and limited audit trails. Overall, QBO is a solid software for small businesses, but Sage Intacct and Xero offer greater scalability.

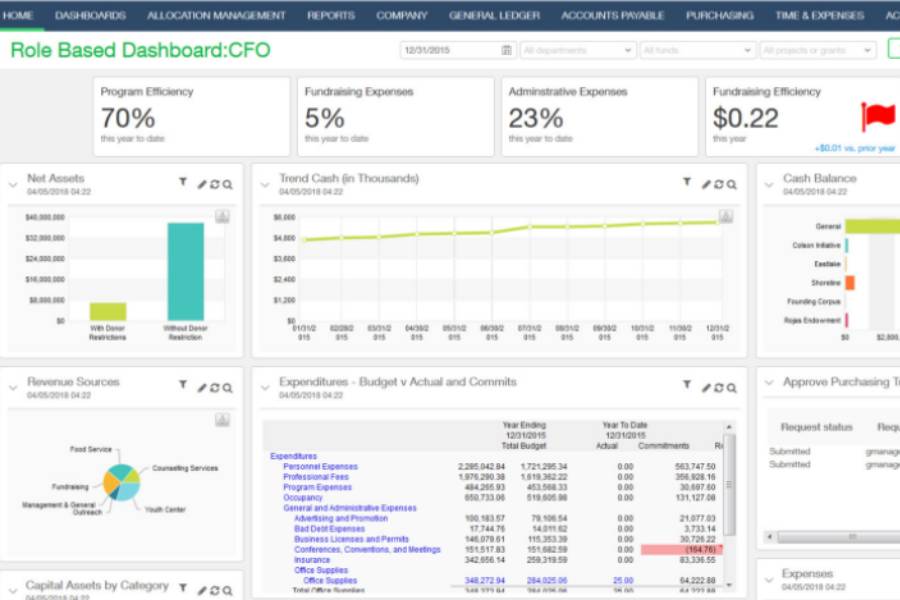

2. Sage Intacct

Sage Intacct is a “best-in-class” financial management solution geared towards enterprise-level SMB’s and more appropriately compared with NetSuite, Microsoft Dynamics, or Financial Force. It was the first cloud-based ERP system and built as a “best-in-class” instead of an all-encompassing ERP. More simply, it focuses on its core accounting functions, but has an open marketplace with hundreds of apps such as Expensify and Bill.com that seamlessly integrate to build a robust accounting system. Sage Intacct offers accounting features above and beyond QBO and Xero, and when comparing it to NetSuite, Microsoft Dynamics or Financial Force, I choose Sage Intacct.

Pros: versatile platform able to support complex entities, point-and-click customization, robust reporting and dashboards, ability to track and report dimensional data, powerful API with countless integrations

Cons: longer onboarding process than QuickBooks, larger price tag for broader capabilities, requires at least one trained staff member

[Note: Choosing the right accounting software for your business is the most important piece of building a Ximplified accounting foundation. As I mentioned, there are a lot of choices and a lot of different reasons for determining which one best meets your needs. For a more in-depth review of the choices above and others, check out G2 Crowd’s customer review website here.]

Automated A/P & Bill Payments

Bill.com

The next step in becoming paperless and Ximplified is to automate A/P. When I became the CFO of a real estate investment and rental company, I was shocked at the piles of papers, missing bills, boxes of files and the hours upon hours spent recording, printing and mailing checks. Say goodbye to all that! Bill.com is a robust paperless A/P module offering automated data entry, bill approval routing, and online bill-pay system (no more printing and stuffing checks!!) that integrates with QBO, Xero, Intacct and even NetSuite. Bll.com also offers invoicing and a payment gateway for ACH and credit card payments. If you have any significant bills to pay every month, there is no question that Bill.com will save you time, heartache, and money!

Expense Management

Expensify

Making sure your business has an organized system for tracking expenses is crucially important for your financials. We recommend Expensify as our preferred receipt-tracking and expense reimbursement solution because it’s ridiculously easy to use! Scan in physical receipts, attach an electronic copy, or type in the details. You can also control reimbursements, reconcile corporate cards, and sync Expensify with your accounting system from the cloud-based platform. If you work with Ximplifi, we can help you set up your Expensify account so that transactions reimbursable to your company or your employees are tracked and paid out appropriately.

Short-Term Rental Tax Management

Avalara MyLodgeTax

Finally, taxes are one area that every client that comes to us with questions about. While Ximplifi is not equipped to file your taxes, we can help facilitate use of Avalara MyLodgeTax to eliminate your short-term rental tax headaches. What’s even better, MyLodgeTax works with a wide range of vacation rental management platforms and accounting software. In addition to helping you calculate your annual taxes, Avalara MyLodgeTax will renew tax licenses and permits on your behalf for as long as you are a customer.

Conclusion

As mentioned above, this list is far from all-encompassing, but using any of the apps above alone or in conjunction with others will Ximplifi your accounting, give you back time, and put dollars on your bottom line. Contact our team today for a free assessment and begin the journey to Ximplifi.

Accounting for Vacation Rentals Isn’t Easy. Let Us Help You Do It Right.

Schedule a free assessment today to learn more about integrating any of these applications with your business.

Sincerely,

Jesse K. Ehret, CPA

Owner and Founder

Additional Articles

5 Signs You've Outgrown QuickBooks

Frustrated with QuickBooks?

Download the white paper to determine if you need a more sophisticated system to meet your needs.

Contact Us.

Get in touch with us and we will get back to you.

Want to join our monthly newsletter?

View our Privacy Policy

Sage Partner SaaS Agreement